does florida have an estate tax return

Previously federal law allowed a credit for state death taxes on the federal estate tax. Corporations must file Florida Form F-1120 each year even if no tax is due.

Florida Residents Should Start To Create A Will Or Estate Plan At The Right Time

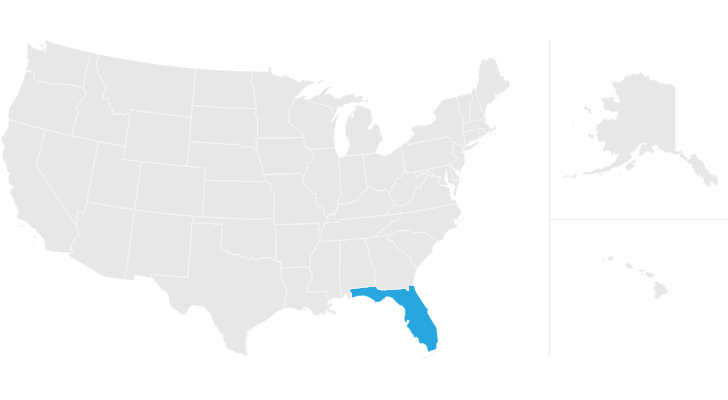

Florida is extremely tax-friendly as it boasts no state income tax which means Social Security income pension income and income from an IRA or 401 k all goes untaxed.

. Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale. Estate income tax returns are only required if estate assets generate more than 600 of income annually. Even though the removal of the federal credit means Florida residents wont have a Florida estate tax liability the lien still automatically applies to any Florida estate.

This applies to the estates of any decedents who have. It does however impose a variety of sales and property taxes and some are. Affidavit of No Florida Estate Tax Due.

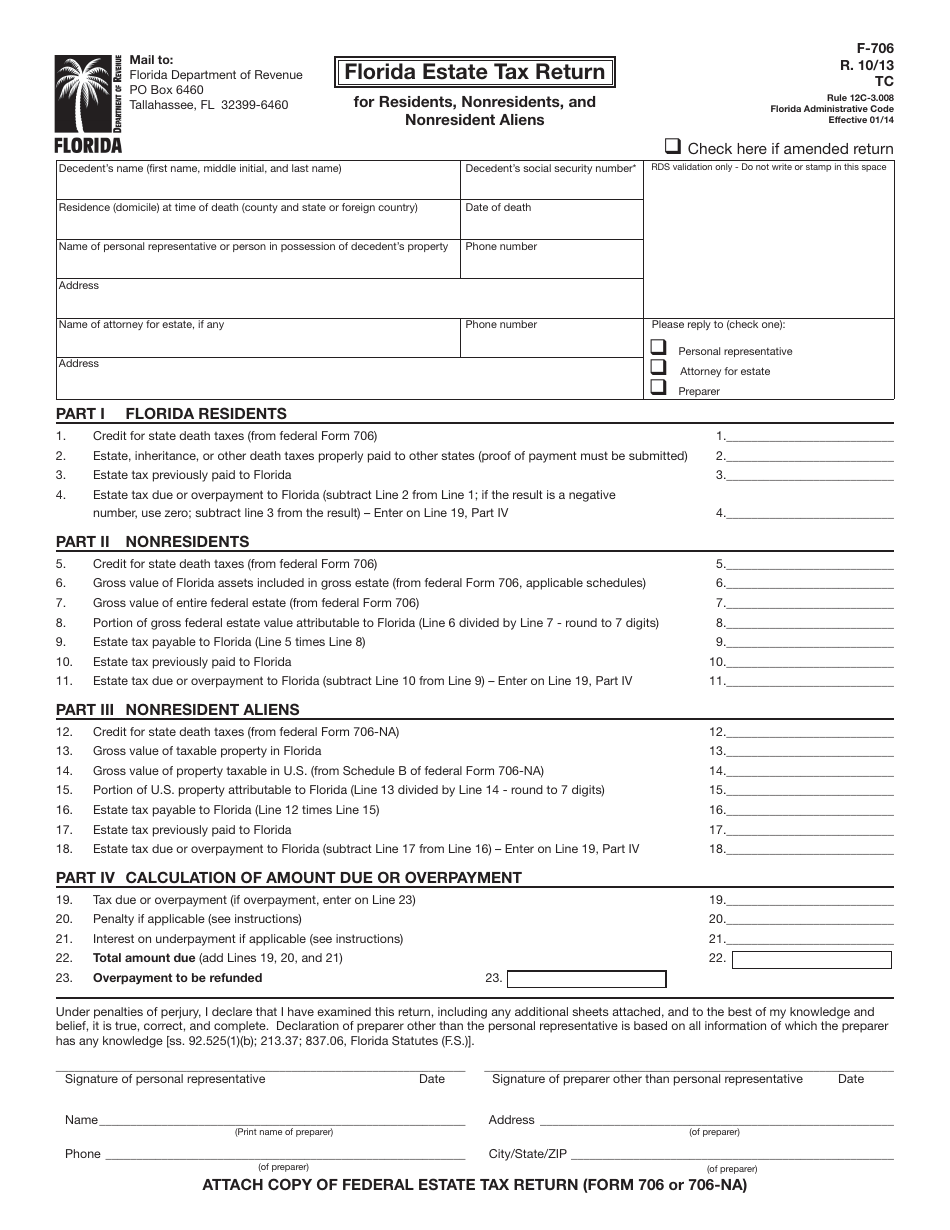

Corporate income tax is reported using a Florida Corporate IncomeFranchise Tax Return Florida Form F-1120. Counties in Florida have the authority to levy an ad valorem tax on tangible personal property. Florida Form F-706 and payment are due at the same time the federal estate tax is due.

Florida does not have personal income estate or inheritance taxes. Sole proprietorships individuals estates of decedents and testamentary trusts are exempted and do not have to file a return. If the estate generates more than.

The types of taxes a deceased taxpayers estate can owe are. If any of the. In 1924 they passed an amendment to the Florida constitution.

Federal Estate Tax. Discover the differences between the types of trusts and the ways the IRS will tax you if you have one. In Florida theres no state-level death tax or inheritance tax but there is still a federal.

Why is there no state income tax in Florida. If the following does not apply to you you are not required to file the return. They must file a return even if no tax is due.

Florida Estate Tax. Does Florida Have an Inheritance Tax or Estate Tax. Floridas general state sales tax rate is 6 with the following exceptions.

A federal change eliminated Floridas estate tax after December 31 2004. Florida Estate Tax Return for Residents. Florida a tax-efficient state does not have an inheritance tax.

See what is deductible if you own a trust in the tax year 2018. The federal estate tax. Taxes on the federal return federal Form 706 is the amount of Florida estate tax due.

Income tax on income generated by assets of the estate of the deceased. Florida doesnt have a personal income tax nor does it have an estate tax or an inheritance tax. You may still pay federal estate taxes if your estate meets the maximum established federally.

The state of Florida doesnt have an estate tax but that doesnt make you exempt from the Internal Revenue Services federal estate tax. Affidavit of No Florida Estate Tax Due When Federal Return is Required. There are no inheritance taxes or estate taxes under Florida law.

![]()

Does Florida Have An Inheritance Tax Alper Law

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

U S Estate Tax For Canadians Manulife Investment Management

Florida Gift Tax All You Need To Know Smartasset

Form Dr 313 Affidavit Of No Florida Estate Tax Due When Federal Return Is Required R 06 11

Does Florida Have An Inheritance Tax Alper Law

Florida Form Estate Fill Out Printable Pdf Forms Online

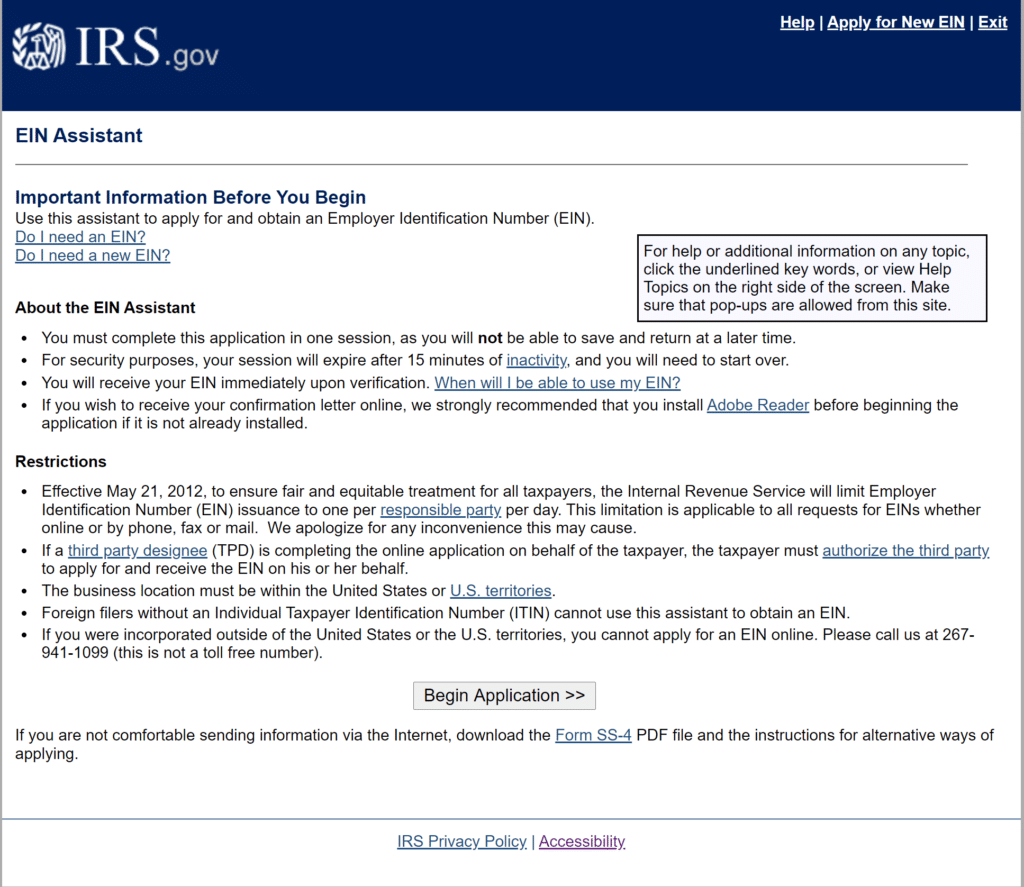

How To Apply For An Estate Ein Or Tin Online 9 Step Guide

Florida Snowbirds From Michigan Considerations In Choosing Your State Of Residence

Form F 706 Download Printable Pdf Or Fill Online Florida Estate Tax Return For Residents Nonresidents And Nonresident Aliens Florida Templateroller

Florida Revocable Living Trust Comprehensive Guide

Estate Tax Definition Federal Estate Tax Taxedu

Does Florida Have An Inheritance Tax Alper Law

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation

Florida Estate Tax Everything You Need To Know Smartasset

Does Florida Have An Inheritance Tax Alper Law

33 States With No Estate Taxes Or Inheritance Taxes Kiplinger

Do I Have To Pay Taxes On Foreign Inheritance To The Irs International Tax Attorney

Florida Estate And Inheritance Taxes Estate Planning Attorney Gibbs Law Fort Myers Fl